LOUISVILLE, Ky. (WDRB) – In late November, Henderson County’s fiscal court backed an increase in Kentucky’s gas tax as part of a broader effort to create more money for roads, bridges and other projects.

In approving their local resolution, the elected officials noted that state road funding continues to decline in their western Kentucky county. The measure urged state legislators to act in the upcoming General Assembly to “avoid further erosion of the transportation network.”

Several magistrates spoke in favor of the move. The vote was unanimous.

“We get it. Everybody gets it,” Henderson County Judge-Executive Brad Schneider said in an interview this week. “You know, any tax increase is obviously controversial, and opinions are all over either side of the question. But at the county level the impact of not adjusting gas tax revenues is felt every day.”

Fuel tax bills failed to advance during the past three sessions of the Kentucky legislature, including one earlier this year that was entangled in a feud between Democratic Gov. Andy Beshear and the Republican state Senate over how Kentucky appoints its transportation secretary.

Now, supporters are ramping up for another push during a short, 30-day General Assembly in 2021. Rep. Sal Santoro, a northern Kentucky Republican who has been the chief sponsor of previous bills, said he plans to file new legislation soon after lawmakers return in January.

His 2020 version, which had bipartisan co-sponsors, sought to raise the state’s 26 cents-per-gallon gas tax by nine cents; add new fees to gasoline-fueled and electric vehicles and adjust a formula that governs how cities and counties receive road funds. In all, it would have boosted the state’s road fund by an estimated $483 million a year.

Republicans who control a supermajority of both chambers already have prioritized several proposals,including measures to overhaul Beshear’s emergency powers over his handling of the COVID-19 pandemic. And the House and Senate must pass a one-year state budget – a matter usually reserved for the longer sessions that happen in even-numbered years.

As a revenue bill, a tax gas measure would start in a GOP-controlled House that buoyed its ranks by adding 20 new members from the November general election. Santoro said he already knows several of the new representatives but plans to meet the others as soon as possible.

Even with other pressing bills, he said the “time is now” for the transportation legislation.

“It’s not a Democrat problem. It’s not a Republican problem. It’s a Kentucky problem,” Santoro said. “And as an elected official, no matter what party you’re from, it’s your problem. So we’ve got to fix it. Its time is now.”

But the length of the legislative session and other Republican priorities could pose challenges.

Sen. Jimmy Higdon, the Republican chair of the Senate Transportation Committee, acknowledged that there are unmet needs as a result of stagnant road funding. He said gas-tax proposals have been common – and largely unsuccessful -- in his nearly 20 years in the state legislature.

Meanwhile, Senate Floor Leader Damon Thayer said this month that it’s “highly unlikely” such a bill will pass in the upcoming session.

“I don’t think raising the gas tax during the coronavirus is a good idea,” Thayer, R-Georgetown, told the Kentucky Politics Weekly podcast.

The state’s levy on fuel, which is tied to wholesale prices, makes up the largest share of Kentucky’s road construction fund. The tax has remained at 26 cents per gallon since 2015, when lawmakers approved that amount as a “floor” that can’t go any lower even if gas prices fall.

Since then, six of Kentucky’s seven neighboring states have raised their gas taxes; in Missouri, legislators voted for an increase in 2018, but voters rebuffed it.

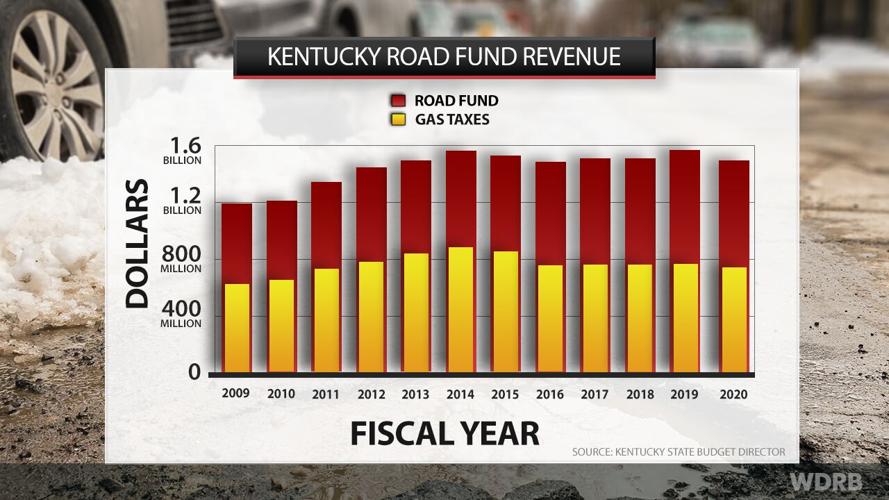

Despite modest growth in recent years, Kentucky’s gas tax revenues haven’t kept up with inflation. And changes in travel and driving during the COVID-19 pandemic have lowered those collections even more.

The tax generated $740.8 million for the fiscal year that ended in June, down some $31.5 million from the same period in 2019. When adjusted for inflation, that was the lowest since at least 2009, according to a WDRB News analysis.

The road fund also dipped, to $1.49 million during the most recent fiscal year, the lowest inflation-adjusted level since 2010.

To date, Henderson County is among at least 30 counties that have passed similar resolutions urging Kentucky lawmakers to tackle sweeping changes to taxes, fees and road-dollar formulas. Other powerful interest groups also support higher fuel taxes, including the Kentucky Chamber of Commerce, Greater Louisville Inc., and statewide organizations representing counties and cities.

It's the top legislative priority for the Kentucky League of Cities, which says city spending on roads and bridges in the state rose 35 percent over the last decade as state and federal sources fell by nearly 24 percent. At least nine cities have approved resolutions, according to the league, although more are expected early next year.

This year’s bill would have changed revenue sharing formulas to give cities a greater share of gas-tax revenues.

Beshear’s transportation secretary, Jim Gray, said this week that Kentucky’s road funding is down about $1 billion from the levels prior to 2015 – a drop that has had a “really destructive impact.”

Gray said the efforts from the cities’ and counties’ groups, and the local resolutions, all help the prospects of a gas-tax bill. He said Beshear would back a “revenue enhancement that would be fair, that would be bipartisan and with no strings attached.”

“The good news is that there does seem to be the kind of support that we need,” he said. “Of course, you know, we also recognize that these are really tough times.”

Copyright 2020 WDRB Media. All rights reserved.