LOUISVILLE, Ky. (WDRB) -- Less than a year after Kentucky lawmakers approved tax breaks for large data centers in Louisville, developers announced plans for a 153-acre project near Shively.

Besides the basic real estate needs, such as available land and sufficient power and water, organizers say the incentives played a role in their decision to target the Camp Ground Road site. They plan to start building a campus there this year for a tech giant that would process and store massive amounts of digital data.

The legislation exempts data centers that invest at least $450 million in city limits from paying sales and use taxes for 50 years on computer equipment and other gear that helps run the sprawling facilities. A shorter 15-year exemption applies to companies that do site development work.

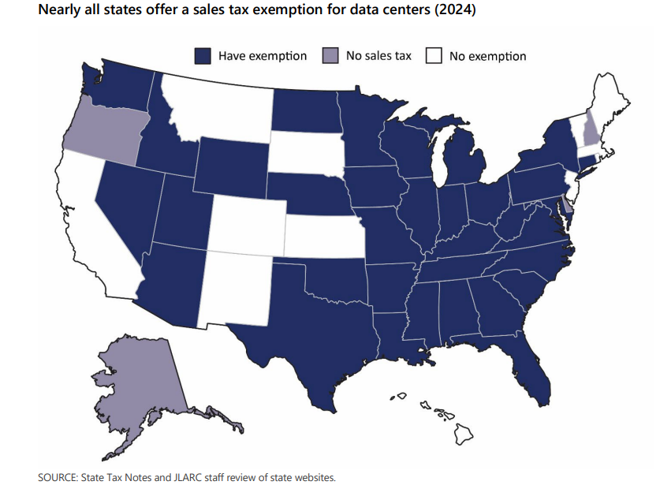

More than 30 states have enacted incentive programs for data centers, according to a recent report from the Commercial Real Estate Development Association. And while Kentucky's package focuses on Louisville, there now is interest in expanding the enticements to other parts of the state, Senate President Robert Stivers told WDRB News.

Stivers, R-Manchester, said he's heard from representatives of tech companies that want the existing incentives available to more communities.

Kentucky State Senate President Robert Stivers, R-Manchester (courtesy LRC Public Information)

"There are entities, individuals who are reaching out to me to look at an additional draft to tier it out to where it would be available and an incentive for more rural areas in the state," Stivers said in an interview last month. "And those inquiries have been coming for the last two or three months about, 'Will you work with us about broadening the legislation?'"

He didn't name specific groups, saying only: "You can guess who all the large entities are that are of interest."

No bills addressing data center tax breaks have been filed as of Feb. 10.

State data shows just one company — Google and its affiliates — lobbied Kentucky lawmakers on sales and use tax exemptions for data centers in 2024.

That work, records indicate, occurred from September through December. The next round of lobbying disclosures for the General Assembly, which began in January, is due Feb. 15.

"Kentucky did a great job of emulating some of the best-in-class states like Virginia and Indiana and came up with an incentive package that meets and exceeds some of our peer states," said Hank Hillebrand, president of Louisville-based Poe Companies, a real estate developer that is working with PowerHouse Data Centers of Virginia.

PowerHouse CEO Doug Fleit said the tax incentives are "one of the key attractions to Kentucky and to Louisville."

source: Virginia Joint Legislative Audit and Review Commission

But as the data center industry continues to grow, some policymakers and analysts are evaluating such programs and suggesting ways to improve them to balance environmental, energy and other concerns.

Washington's governor signed an executive order last week creating a workgroup to review data centers' impacts on tax revenue, employment and other areas. The state's tax breaks program has come under scrutiny in recent years, including for scant transparency about how many high-paying jobs have been created.

In Virginia, a leading market for data centers, a legislative committee released a report late last year reviewing the state's sales tax exemption ahead of its scheduled end in 2035.

It found that the main economic benefit from such centers comes during construction, although some communities have reaped "substantial" money from property taxes – 31% of all local revenues in Loudoun County in northern Virginia, for instance.

The report stops short of suggesting how Virginia lawmakers ought to act, but it floats policy options that include leaving the tax breaks intact, abolishing them and offering a partial exemption that still would send money to state coffers.

Other ideas include adding required noise studies and energy use requirements for the campuses that need vast amounts of power.

"I do think the fact that they paused and had a report prepared indicates that there are some things that people need to think about on the front end," said Pam Thomas, senior fellow at the progressive Kentucky Center for Economic Policy.

Thomas, a former legislative analyst, questions the 50-year exemption period in the Kentucky data center bill passed last year. She said lawmakers should consider mandating routine reporting – perhaps every five years – to show what companies have purchased while they avoid sales taxes.

"We should have more information as taxpayers — and the legislature should as policy makers — about exactly what they're spending the money on," she said. "I mean, if you're going to give them these big breaks, then you should make them report more information, more specific data to you every five years in order to get it to continue."

Andrew McNeill, president of the conservative-leaning Kentucky Forum for Rights, Economics & Education, said Kentucky shouldn't rush to broaden its program without public input. Those talks, he said, should occur during the interim period between meetings of the legislature.

"I haven't seen any type of real serious conversation or discussion about that during the interim, or with the public or with the taxpayers," McNeill said, "In my opinion, taking the time to get it right is as important as getting it done."

Amazon Web Services data center is seen on Thursday, Aug. 22, 2024, in Boardman, Ore. (AP Photo/Jenny Kane)

The data center industry is booming, with analysts predicting the number of large centers like the one planned for Louisville will double worldwide within the next four years.

To the left-leaning Good Jobs First watchdog group, there's no need to subsidize facilities that tech giants need to build as part of their business of powering the internet, senior research analyst Kasia Tarczynska said.

But if subsidies are used, they ought to be limited so that states don't have soaring increases in tax revenue that goes uncollected, she said, citing research showing Virginia's sales tax exemptions rising from $65 million to $750 million over just six years.

"We would like to see caps on how much one company can access in one particular year, how much can be abated for the industry in one single year, so that we don't see these unprecedented costs to residents, to the public," Tarczynska said.

She said it's "very concerning" that Kentucky's legislation doesn't have such caps. "We might see the same situation in Kentucky as we are seeing now in Washington State, in Texas, in Georgia or in Virginia."

For now, however, there is just one data center project being tracked in Kentucky.

The developers expect the Camp Ground Road site will create hundreds of full-time jobs and employ perhaps up to 1,000 construction workers – an overall investment estimated at "several billions of dollars," according to Hillebrand of Poe Companies.

He said he believes the project will result in "tens of millions of dollars of taxes annually, and that'll feed obviously the county, the city, the state and the school system."

The interest in data centers in Kentucky is a direct result of the sales tax incentives passed last year, said John Bevington, senior director of economic development for PPL Corp., of which LG&E and Kentucky Utilities are subsidiaries.

He told WDRB in January that his team is in discussions with about 16-20 data center proposals at any given time. Several years ago, he said, an interested company noted Kentucky's lack of tax breaks as a reason why the state wasn't attractive.

"They coined Kentucky a data center desert because we didn't have a sales tax exemption program that would enable major data centers to be looking at the state," he said. "I think that was an essential component of this opportunity pipeline being what it is today."

Copyright 2025 WDRB Media. All Rights Reserved.