LOUISVILLE, Ky. (WDRB) -- A Louisville business owner is facing more than a year in prison for failing to pay federal income taxes, a crime that federal investigators said puts hundreds of people in jail annually for nearly $6 billion in fraud.

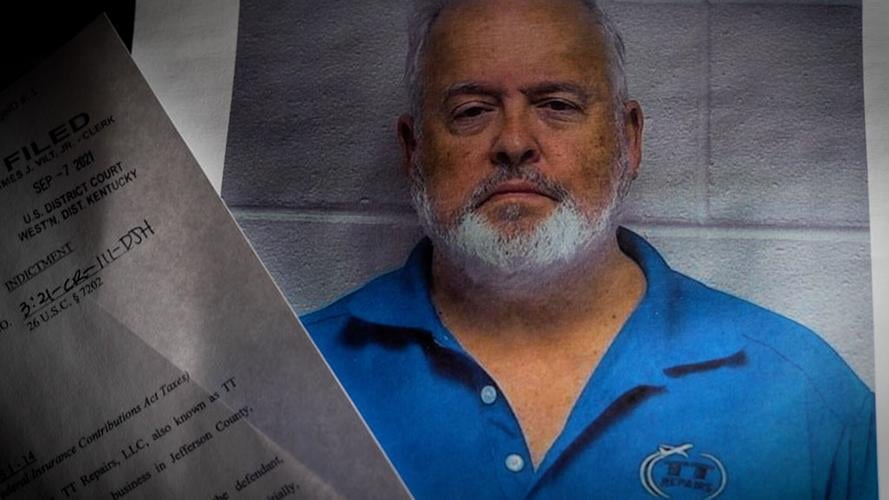

Christopher Moyer ran TT Repairs LLC, an aviation repair shop near the Louisville Muhammad Ali International Airport. He was recently released from jail as he waits for his 15-month prison sentence to begin later this spring.

"Sometimes, people think that it's a white collar crime, (that) they didn't hurt anyone. But, in fact, they stole from the system," said Bryant Jackson, special agent in charge at the Internal Revenue Service. "(Moyer) took advantage of the system and he took advantage of his workers as well."

Last month, Moyer was federally sentenced for failing to pay federal income and insurance taxes from 2015-18.

"He withheld taxes from his employees' paychecks," Jackson said. "But, instead of paying that over the IRS, he took that money and lived lavishly, bought expensive cars, lived an expensive lifestyle on that money that should've been turned over to the IRS as taxes collected."

Christopher Moyer ran TT Repairs LLC, an aviation repair shop near the Louisville Muhammad Ali International Airport.

Moyer was ordered to pay $1.2 million in restitution.

In fiscal year 2022, the IRS' criminal investigations team identified $5.7 billion in tax fraud nationwide. The agency said it investigated more than 1,300 criminal tax cases with nearly 700 people sentenced.

In December 2021, a federal grand jury in Louisville returned an indictment charging a Louisville couple, Krlos Hidalgo and Esther Baldeon, with aiding in the preparation of false tax returns. According to the indictment, Baldeon helped in the preparation of false tax returns that contained false dependents.

Investigators said the purpose of the false dependents was to obtain Additional Child Tax Credits for the taxpayers. Between 2012-16, Baldeon and Hidalgo are accused of knowing that the taxpayers were not entitled to the Additional Child Tax Credits.

If convicted, Baldeon faces a maximum penalty of 15 years in prison, and Hidalgo faces a maximum penalty of 12 years in prison. Both are scheduled in court in late March for another hearing.

And in October 2022, Louisville attorney Keith Hunter was sentenced to 27 months in prison and was ordered to pay a $15,000 fine. Jackson said he concealed his assets from the IRS.

"Mr. Hunter was a local attorney, who, instead of taking payments, he received from clients and client settlements and put it in an account that attorneys can't touch," Jackson said. "He took that money and lived a lavish lifestyle."

Investigators said the 65-year-old from the Zielke Law Firm owed more than $1.1 million for not paying taxes between 2000-11.

Bryant Jackson, special agent in charge at the Internal Revenue Service

"He bought expensive cars, even bought his house in a nonprofit organization," Jackson said. "... He didn't file any of that as income on his tax returns. He took that money from his clients' potential settlements and did what he wanted to do with it. That's fraud. You can't do that."

Calls to Hunter's former firm went unanswered.

Moyer was allowed by the court to take a business trip earlier this year to Dubai for an "aviation convention" so he could attempt to sell his business.

He declined an on-camera interview for this story but in an email said he had little to add to the federal conviction.

"Most of the monies not paid were left in the business, and, doing that, I’ve built a successful enterprise that does business on every continent," he wrote.

Jackson said IRS investigators go back six years to look for patterns in people's financial history.

"Eventually, they will get caught," he said of people who try to skirt the law. "There are mistakes, (but) those are not the people we are interested in. We're interested in the people who did the behavior, last year, the year before that.

"We're out there. We will investigate and we will prosecute to the extent of the law."

If you have information about this story or any story you think our investigates team should look into, you can email us at investigate@wdrb.com.

Copyright 2023 WDRB Media. All Rights Reserved.