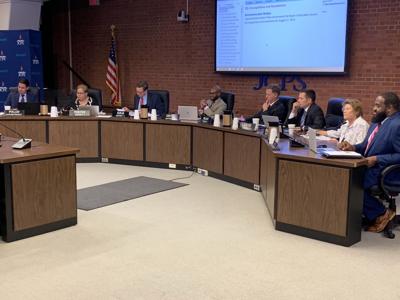

LOUISVILLE, Ky. (WDRB) -- The Jefferson County Board of Education voted 5-2 Thursday to increase the district’s property tax rate by 7 cents per $100 of assessed property value, setting up a potential recall at the polls in November if opponents can garner enough support.

Board members Diane Porter, Chris Kolb, James Craig, Corrie Shull and Joe Marshall voted for the rate increase while board members Chris Brady and Linda Duncan voted against it.

Jefferson County Public Schools Superintendent Marty Pollio recommended the board pass the higher tax rate, which puts the district's tax rate at 80.6 cents per $100 of assessed property value and is estimated to generate $51.5 million more in revenue. That would generate about 11% more in property tax revenue than collected for the 2019-20 fiscal year.

"If we don't do this now, we are at least two years before we have this opportunity again," Pollio said, referencing the possible recall vote that could occur in November. Opponents will have 50 days to gather enough signatures through a recall petition to put the matter before voters this fall.

He stressed the need to build at least two new middle schools and a new high school in west Louisville as part of the district's efforts to revamp its student assignment plan.

The board is contemplating offering a chance for students who live in that area, who are bused to middle and high schools throughout Jefferson County to promote racial diversity, to have an option to attend schools closer to their communities as part of revisions to the district's student assignmnet plan.

Pollio said it would cost an estimated $139 million to build the two new middle schools and new high school to make that possible, and raising property taxes would allow JCPS to do that much sooner.

"The residents of west Louisville should be upset with JCPS for not investing in that community over the past 30 years," he said. "It is time to right that wrong."

Board members who voted in favor of the tax increase stressed the need to spend more on facilities and in classrooms throughout the district.

"Our kids, no matter where they live, they need academic help," said Porter, the board's chairwoman who represents District 1. "So while we're talking about building facilities, let's dig in and come up with some academic help with these children that are struggling."

However, Brady and Duncan expressed their concerns about raising property taxes during the COVID-19 pandemic that has forced many out of work.

Brady, who represents District 7, said he would have supported the board's pursuit of more tax revenue, "but we no longer live under normal circumstances."

"Over 40 million Americans are unemployed, including a third of Kentucky's workforce," he said.

"I don't want this board to burn the respect and goodwill we've earned over the last years by becoming so focused on this issue that we seem removed from and unconcerned about the fear, anxiety and uncertainty many of our families have faced in this newly transformed world."

Others on the board said they see little reason to wait as the pandemic threatens to exacerbate problems for those already struggling in Jefferson County.

Kolb, the board's vice chair who represents District 2, said the roughly 65,000 JCPS students who live in poverty "have been dealing with tough times their whole lives, dealing with things tougher than we can imagine in many cases."

He urged the board to vote unanimously on the proposal and "send a strong message" to a community that could ultimately decide the tax increase's fate.

"If you vote against this, you are depriving parents of that choice," Kolb said. "You are in effect saying you don't believe that the parents in this community should have the ability to choose if they want to fund their kid's education."

Supporters of higher property tax rates outnumbered opponents during Thursday’s hearing before the school board, which occurred before the vote.

Four of the seven speakers during Thursday’s hearing, who addressed the board one at a time through videoconferencing at VanHoose Education Center while practicing social distancing, backed upping the property tax rate to build new schools and fix existing facilities, hire more staff and develop robust learning supports around students, among other spending possibilities.

“It’s time to go beyond quick fixes and implementing a Band-Aid approach when addressing needs in our district,” said Faith Stroud, principal at Robert Frost Sixth Grade Academy and Stuart Academy.

“We need to make a bold commitment to replace the crumbling infrastructure in our district due to the fact that we serve scholars who need the most support and resources in the whole district.”

Stroud said 87% of her 1,250 students receive free or reduced-price meals and said her building needs more resources to better serve their needs.

Additional funding could also help her hire more teachers. Her school had eight vacancies that remained unfilled throughout the 2019-20 school year.

“I agree with Dr. Pollio about this needed, this very needed tax increase because it’s about equity,” Stroud said. “It’s about meeting the needs of our kids.”

Her sentiments were echoed by others who backed raising property tax revenues for JCPS.

Sadiqa Reynolds, president and CEO of the Louisville Urban League, called the lack of investment in education locally “shameful.”

She urged the board to invest higher property tax revenues in areas like facilities, teacher pay and technology, the latter of which has emerged as a vital learning tool with school districts forced to stop offering in-person instruction amid the COVID-19 pandemic.

“I think JCPS owes it to these students to ensure that they have what they need,” Reynolds said, advocating for every student in the district to be provided a device. “... We do not have the time to waste. The Urban League will stand behind you.”

Not everyone was on board with the proposed property tax increase, originally advertised at 8 cents per $100 of assessed property value, during Thursday's hearing.

Shirley Green suggested that the elderly cannot afford to pay higher property tax bills while living on fixed incomes, and Gerald Hensel noted that 2.4 million people filed initial unemployment claims across the U.S. last week.

In Kentucky, nearly 800,000 have filed for unemployment since the pandemic began in March.

“If people are unemployed or out of work, right now their main this is trying to put food on their tables and feed their kids and family,” Hensel said, noting that many are also struggling to make mortgage payments.

“We’re going through a very bad time just to survive right now,” he said.

The 7-cent uptick in the property tax rate would push the district’s rate to 80.6 cents per $100 of assessed property value, which would mean those who own $100,000 homes would owe $806 in property taxes starting this fall.

But an effort to gather enough signatures to put the property tax increase in the hands of voters has already emerged since the uptick would generate more than 4% in revenue growth, which school boards can take without triggering a possible recall.

Theresa Camoriano, president of the Louisville Tea Party, has said a group is formalizing plans to collect signatures for a possible recall vote once a new tax rate is set. She called the pandemic the "worst time to raise anybody's taxes."

A website domain, NoJCPSTaxHike.com, has already been secured to help the group's efforts to electronically collect the 35,615 signatures needed over a 50-day period to put an increased tax rate before local voters in the fall elections, Camoriano said. The signatures must be collected from registered voters who live in the affected area.

JCPS has also begun laying the groundwork to boost community support in defense of the rate increase.

The district signed a contract worth up to $575,000 with Danville-based consulting firm Osborne & Associates to handle public relations for its pursuit of higher taxes.

Copyright 2020 WDRB Media. All Rights Reserved.