LOUISVILLE, Ky. (WDRB) -- A Jefferson County Public Schools property tax hike remained on the ballot Tuesday, despite a judge throwing out the question just days before Election Day. Taxes are going up either way in Jefferson County, the question now is by how much.

Homeowners in Jefferson County will notice a 4-percent hike in their property taxes on this month's bill, which the school board previously approved.

"That is the allowable tax that's not recallable, which will be on the property tax bills that are out right now," JCPS spokesperson Renee Murphy explained. "In November of 2021, the full amount that the board approved would be on that bill, if everything plays out in court and the judge's decision is upheld."

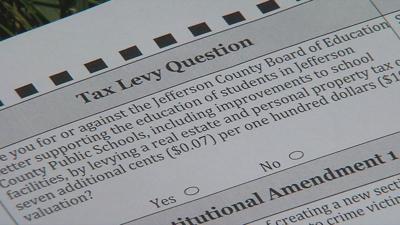

Votes on the tax were not tabulated by the Jefferson County Board of Elections on Tuesday night, after a judge tossed the challenge against the tax on Friday, ruling the No JCPS Tax Hike group did not get enough valid signatures against the 7-cent property tax increase.

Opponents of the tax were pleased that the full increase will not immediately take effect.

"I'm very pleased to hear that because that will help us in our appeal. We won't have to ask for a refund, we will just have to ask for that bill not to be sent," said Theresa Camoriano with No JCPS Tax Hike. "We definitely disagree with the (judge's) decision for a number of reasons, and we're optimistic that we'll win on appeal."

Those who voted in person may have seen signs posted at the ballot box that said, "Votes cast on the (JCPS) tax levy will not be tabulated or recorded."

According to the judge's order, those ballots have to be saved. If the ruling is struck down, then the votes will be counted. If the ruling stands, then the rest of the tax increase (above 4%) will take effect in November 2021, according to JCPS.

Related Stories:

- Former skeptics now backing JCPS tax increase say detailed spending plan sealed support

- Judge tosses petition challenging JCPS tax increase due to insufficient signatures

Copyright 2020 WDRB Media. All Rights Reserved.