LOUISVILLE, Ky. (WDRB) – Braidy Industries has secured $200 million in funding for its planned aluminum rolling mill in Ashland, Ky., thanks to an investment from Russian aluminum giant United Company Rusal PLC.

Rusal will become Braidy Industries’ “exclusive supplier,” providing $500 million in prime aluminum annually to the Kentucky rolling mill for 10 years, the companies said in a news release Monday.

Rusal and its parent company, En+ Group, were under U.S. sanctions until January – when the Trump administration lifted them. The sanctions were in retribution for Russia’s alleged meddling in the 2016 U.S. presidential election, the Wall Street Journal reported.

En+ Group and Rusal are partially owned by Russian oligarch Oleg Deripaska, who remains under personal sanctions by the U.S. government.

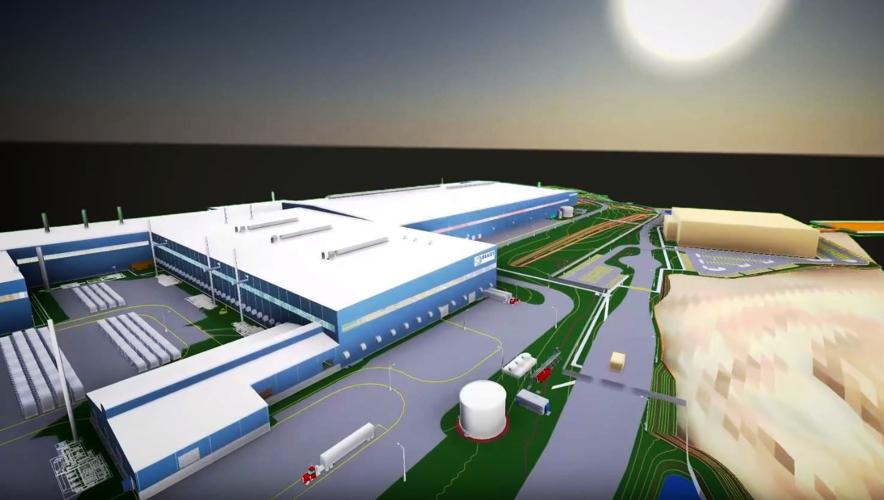

The $200 million investment from Rusal helps Braidy Industries, which is partially owned by Kentucky taxpayers, toward its goal of raising $500 million in equity. The $500 million is needed so Braidy Industries can finance construction of the $1.7 billion mill, which the company says will open in 2021.

“This strategic partnership aims to create on an end-to-end basis, the first low-carbon impact industrial aluminum rolling mill operation in the world,” Braidy Industries said in a press release.

In an interview with CNBC that aired Monday, Braidy Industries founder and CEO Craig Bouchard brushed off questions about doing business with Rusal, saying any cloud hanging over the company from the U.S. sanctions will soon clear.

Braidy Industries CEO: Rusal will be a superstar company from CNBC.

“It reminds me a little bit of that song in 2000, 'Nobody's Perfect.' If you remember Hannah Montana, everybody loved her at the time. Then she became a teenager -- Miley Cyrus – and the media got on her a little bit, and now she is a beautiful, married woman,” Bouchard said. “I expect that Rusal comes out of this as the superstar company in our industry.”

Braidy Industries has said it will churn out the lowest-cost aluminum sheet in the world for customers like car and aerospace manufacturers.

Vehicle makers have shifted to aluminum as a lighter alternative to steel, giving cars and trucks better fuel economy.

“The automotive (manufacturers) are all going after sustainability and low-carbon, and I think we’re going to be their favorite supplier,” Bouchard told CNBC on Monday.

In exchange for the $200 million investment, Rusal will get a 40 percent stake in Braidy Atlas, the Braidy Industries’ subsidiary that will own and operate the mill.

The Wall Street Journal reported Sunday evening that Bouchard said the Rusal investment “would enable” Braidy Industries to reach the $500 million in equity needed to borrow $1.2 billion for the mill’s construction.

But a Braidy Industries executive did not directly answer when asked if the company has actually raised the $500 million.

In an email Monday evening, Braidy Industries vice president of business development Jaunique Sealey repeated the company's previous assertion that it has "over $1 billion in indicated interest from prospective equity investors."

"The prospective partnership with Rusal, which includes a $200 million strategic investment, meets our qualifications for a lead investor and enables us to create the “golden triangle” customer proposition in heavy industry – lowest cost, highest quality, and lowest-carbon footprint in end-to-end production," Sealey said. "It is a winning combination. We are now in the late stages of our private equity raise."

Braidy Industries, a private company, is in the midst of a stock sale that is scheduled to wrap up June 15. Bouchard said he plans to take the company public in July, the Wall Street Journal reported.

Kentucky state government was one of Braidy Industries’ first investors. The state put in $15 million in May 2017 as part of Gov. Matt Bevin’s effort to land the plant and its expected 600 high-wage manufacturing jobs in the state’s Appalachian region.

Some Republican opposed lifting sanctions on Russian firms

Trump’s Treasury department said in December that it planned to lift sanctions on Rusal and En+ Group after Deripaska agreed to reduce his ownership in the companies.

In January, some Republicans joined Democrats in an unsuccessful effort to block the Treasury department’s move and keep the sanctions in place.

Senate Majority Leader Mitch McConnell, R-Kentucky, opposed the effort to block the sanctions relief on the Russian companies, the New York Times reported in January.

A spokesman for McConnell said in an email Tuesday that the Braidy Industries investment played no role in McConnell’s stance on the sanctions.

The spokesman referred to McConnell's statement about the issue on Jan. 15, in which the Senate leader called Deripaska "corrupt" but said his influence over En+ Group and Rusal would be limited under the agreement to remove the sanctions. Deripaska's companies would be subject to "unprecedented transparency and monitoring requirements," McConnell said in January, and the Treasury department could slap the sanctions back on at any time.

Braidy Industries is looking for more help from the Trump administration to make the aluminum mill a reality: It is seeking $800 million in below-market financing from a U.S. Department of Energy program aimed at helping produce efficient vehicles.