LOUISVILLE, Ky. (WDRB) -- It's that time of year again: tax season. But this year, some people might not get back as much as they expect.

Filing taxes this year isn't going to be as complicated as the past few years, one local tax accountant said. However there is one big change he said tax filers need to be aware of.

"That big one is that doggone child tax credit," Richard Zenger, owner of Zenger & Young Tax Services, said. "It's killing people."

According to the Internal Revenue Service (IRS), more than 168 million Americans are expected to file their taxes this year.

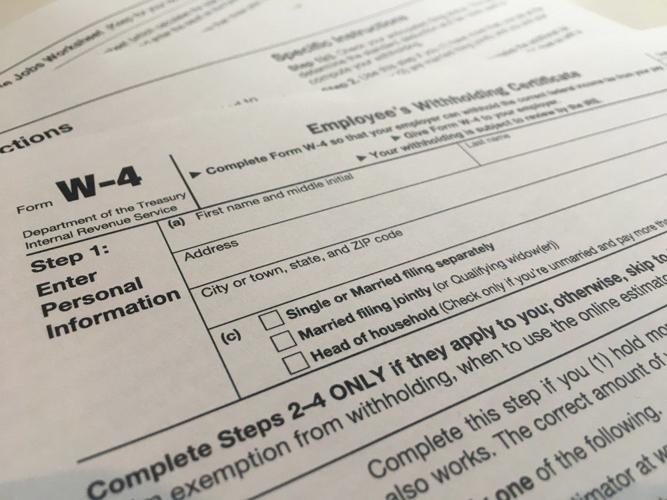

But parents should be aware that the child tax credit has dropped because the IRS is going off of pre-COVID calculations. Last year, it was $3,600, this year it's $2,000. But Zenger said only up to $1,500 is payable, adding that anyone who is counting on their refund should be patient.

While some companies allow you to take a loan against your refund, Zenger said, heavy fees can come with that. He advises tax filers to wait about 20 days for their refund to process. Additionally, he said those who are already behind should file their taxes anyway.

"If you owe, still file your taxes. Even if you can't pay, file the tax return," he said. "(Because) if you don't file it and you owe, whatever you owe, you can plan on doubling that number between penalties and interest."

The deadline to file taxes for most Americans is Tuesday, April 18.

While Tax Day is typically designated as April 15, this year's deadline differs due to April 15 falling on a Saturday.

Copyright 2023 WDRB Media. All Rights Reserved.