JEFFERSONVILLE, Ind. (WDRB) -- Many Hoosier homeowners will soon see some property tax relief.

"Makes me feel great," Michele Engle said. "Everything else has gone up, so it's nice to have something decrease in price."

The Indiana General Assembly passed Senate Bill 1, which is designed to lower property taxes and prevent future tax hikes earlier this week. However, there could be a catch.

Senate Bill 1 allows homeowners to claim a tax credit worth 10% of their property tax bill, up to $300.

"Every little bit helps," Charlie Thompson said when he heard the news. "I'll take anything I can get."

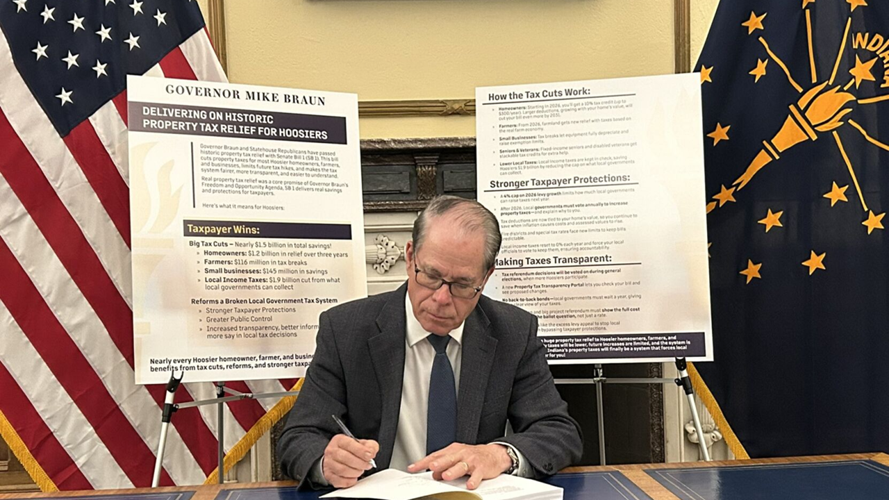

Everything, from the cost of groceries to gas, adds up fast. That's why many Hoosiers are excited to hear Indiana passed Senate Bill 1. Gov. Mike Braun calls the property tax relief "historic," and believes it will help nearly every Indiana homeowner, farmer, and business owner.

Gov. Braun said two-thirds of homeowners will pay less on their property taxes in 2026 than in 2025. Senate Bill 1 also increases exemptions for business personal property taxes.

Hoosiers, last night we delivered on nearly $1.5 billion in property tax cuts. Nearly every homeowner, farmer, and business owner benefits from tax cuts, reforms, and stronger taxpayer protections. Check out the highlights here! pic.twitter.com/cgYUq5VQcH

— Governor Mike Braun (@GovBraun) April 15, 2025

However, the bill has its fair share of controversy. Hundreds of teachers protested it because they were concerned it would cut public education funding.

"I don't want to feel like I'm causing a problem at the school system for sure," Hoosier Tom Williams said.

All across southern Indiana, property tax money also funds first responders.

"It goes towards streets, sanitation, parks, police, schools," said Jeffersonville City Council President Evan Stoner. "It goes towards making sure that our city is running smoothly and making sure that the county is operating."

WDRB spoke with several people who live in Indiana who said they didn't want those critical services to lose money or resources.

"I don't think you should ever take anything away from our first responders, our teachers, or our schools," Thompson said. "That's the backbone of our country."

Stoner said Jeffersonville could lose up to $5 million in taxpayer dollars over the next few years because of Senate Bill 1.

"When we looked at the original numbers that had been sent out, Clark County was one of the was the only county in the state of Indiana that didn't lose anything from this legislation," Stoner said. "Then, when you look deeper into it, it appears that the City of Jeffersonville will lose out on $5 million. Maybe it's the type of thing where we're not going to get as much as we were going to get of our levy."

To recover lost funding, the bill allows cities and towns across the state to create their own local income tax. That's up to 1.2%.

"It's more of a shifting of that burden," Stoner said. "Bottom line, there's critical services that the city must fund, that the city must ensure are running properly."

Stoner said it would be the first time Jeffersonville had a local income tax. He also said the city council board would have to vote to approve it, if the city moves in that direction.

"And anything that we would do would obviously have to have support from the public," Stoner said.

According to a post on Braun's X account, the bill will provide Hoosiers nearly $1.5 billion in tax relief, with homeowners saving $1.2 billion over three years.

More Top Stories:

Former Scott County Sheriff arrested in expanding Jamey Noel corruption case

Kentucky officials accused of falsifying records to fail disabled police recruit

Driver allegedly hits teen, attacks cars with sledgehammer near Louisville VA Hospital

Copyright 2025 WDRB Media. All Rights Reserved.