LOUISVILLE, Ky. (WDRB) – One year into the brave new world of the college athlete endorsement and compensation era, the landscape remains varied, shifting, and wide-open. Coaches have called it the “wild west,” with some schools (or their representatives) rushing into the space aggressively, and others sitting back to gauge the landscape.

Getting a handle on the scope of money being spent (or made, from the standpoint of athletes) is difficult. There are no rules regarding disclosure, nor laws that compel athletes to disclose earnings.

But after one year, companies that are involved in the space are beginning to get a look at the first data to emerge, and it is enlightening. One of those, Opendorse, was one of the first into the NIL fray, and represents more than 1,000 NCAA schools and 70,000-plus athletes.

It recently released a report on its first year in the NIL business, and while it is only one company, the results are worth looking at, because they are the first comprehensive set of numbers compiled, and because they do represent a sizable portion of the market.

The company projects that the market spend in the coming year for college athlete NIL deals will be $1.14 billion. The largest share of that ($234.5 million) will be spent in the southeast – Florida, Georgia, North Carolina and South Carolina.

Here are 10 of the most interesting findings from the report:

1). SUNSHINE (AND WINDFALL) STATE: Based on projections for Year 2, the state of Florida will lead the way in NIL money. That’s no surprise, with major football universities like Florida, Florida State and Miami. But other Division I institutions also help that bottom line.

An estimate of the top states for total NIL compensation compiled by Opendorse.

Kentucky didn’t crack the top 10, but the Bluegrass State is punching above its weight, at 17th nationally, just ahead of Utah, Connecticut, Iowa and Tennessee.

Remember, these are numbers compiled by Opendorse based on athletes who are doing deals with it.

2). WHERE IS THE MONEY COMING FROM? Using only schools that subscribe to its top level of service and who are engaged only at the highest level of NIL operations, Opendorse estimates that 76% of athletes at those schools have had at least one NIL deal.

Of the deals offered, 74% have come from brands, 15% from donors and 4% from fans. But the amount from donors began to rise markedly in late 2021 with the advent of collectives, which also are beginning to activate fan involvement, too.

In all, in the past year, Opendorse says 35% of all NIL compensation in Division I came from donors.

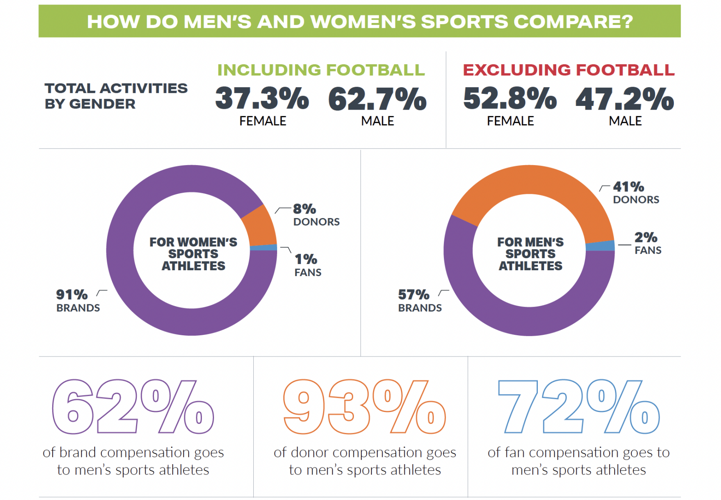

3). GENDER GAP. In all, 62% of NIL deals go to men’s athletes and 37.3% to women. But take football out of the equation, and women are drawing 52.8% of the deals in the rest of the sports, and men 47.2%.

The source of NIL deals for men and women is telling, with corporations and other brands spending more of their money on women, and fans and donors overwhelmingly backing men.

A chart comparing compensation by gender in a report on NIL compiled by Opendorse.

Companies make up 57% of NIL deals for men, but 91% for women, while donors back male athletes far more heavily.

For donors, 93% of NIL money spent goes to men, while fans back men with 72% of their NIL spending. Brands, however, send 62% of their NIL spending toward women.

4). FOOTBALL GETS FED. Of all NIL spending with Opendorse, football takes half the compensation pie, with every other sport splitting the rest.

Football drew 49.9% of NIL money, men’s basketball 17% and women’s basketball 15.7%. After that, it’s a steep drop to women’s volleyball at 2.3% and softball at 2.1%

No other sport totaled more than 2%.

5). HOW DO THEY EARN? Of all compensation, 34% was received for posting content. A general category of “other activities” drew 17.8% of revenue. Licensing rights made up 15.9% of compensation and autographs 15.1%.

6). WHICH CONFERENCE LEADS THE WAY? Both in total compensation and in number of deals done with Opendorse, the Big Ten ranks No. 1. In terms of total compensation, it is followed by the Big 12, Big East, Pac-12, SEC and ACC, in that order.

In terms of number of deals, the ACC ranks third, SEC fourth, Pac-12 fifth and American Athletic Conference No. 6.

7). WHAT ARE THE BIG MONEY POSITIONS? Here’s no surprise – quarterbacks make the most (2,128 per NIL deal). They are followed by running backs ($1,864), receivers ($781) and defensive linemen ($758).

In women’s hoops, the money goes to guards ($1,441 per deal) as opposed to centers ($503). In men’s hoops, the money is on the front line, with centers ($1,763 per deal) and forwards ($1,556) outpacing guards ($736).

8). THE BIG O. Kentucky’s Oscar Tshiebwe made headlines for being a reigning college basketball player returning to school, with NIL helping to enable that. While international students can face more NIL restrictions because of their visa status, Tshiebwe apparently cleared that hurdle and has been able to begin making money for his name, image and likeness.

Kentucky's Oscar Tshiebwe fights for a rebound in a victory over WKU on Dec. 22, 2021.

He could make as much as $2 million for returning to Kentucky this season, according to multiple reports. His combined social media following (Instagram + Twitter), has more than 112,000 followers, fourth-most among NCAA international athletes.

9). NIL LEADERS. In a section with more athletes who are leading in the NIL era, Opendorse listed two from the University of Louisville on a page with 25 others. One will not surprise you. Hailey Van Lith has long been reported to have major NIL potential, with 717,000 Instagram followers and 63,800 on TikTok, where she recently posted as a sponsor for Dick’s Sporting Goods.

The other Louisville name might surprise you. Katie Beiler was senior rower for Louisville last season, and her 16,600 TikTok followers had liked her posts more than 2 million times on that platform.

10). WHAT BRANDS ARE THE MOST ACTIVE? Trading card and NFT companies did more deals than any other kinds of brands with Opendorse, including companies like Panini and Candy Digital, making up 17.9% of NIL activities. Mobile apps accounted for 16.5% of deals, with E-commerce at 7.7% and financial at 7.5%.

Where do brands spend their money? More than a third, 36.73%, were spent on licensing rights. Another 34.19% was for posting content. The averaging licensing agreement was worth $9,877, with the average for posting at $156 per post.

With collectives becoming more and more a part of the NIL landscape, Year 2 of NIL figures to look much different. Opendorse reported that 13 of 15 ACC schools had a collective set up on its behalf, with all 14 in the SEC reporting at least one collective and 13 of 14 in the Big Ten.

The college sports world has changed. And the change is only beginning.

Copyright 2022 WDRB Media. All Rights Reserved.