LOUISVILLE, Ky. (WDRB) -- Property taxes are likely about to go up for thousands of people in Jefferson County.

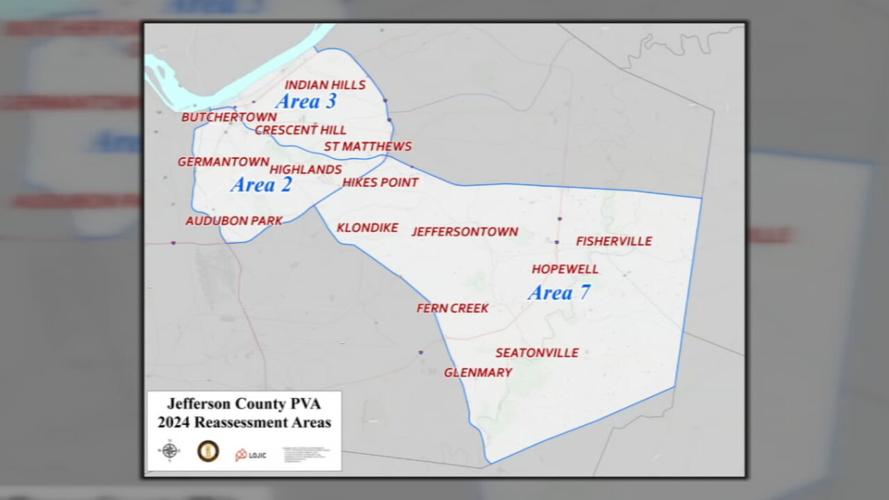

The hike affects homeowners in a lot of different Louisville neighborhoods. That includes areas like Germantown and the Highlands, to St. Matthews and Indian Hills, all the way to Jeffersontown, Fern Creek and Glenmary. Those are the neighborhoods where the Jefferson County PVA reassessed property values this year.

The Jefferson County PVA's 2024 reassessment map.

Tuesday night, PVA Colleen Younger held a meeting explaining the process to homeowners. The reassessments are required by law, and happen every four years.

Tax bills are likely to be higher because of what's been going on for the past several years in the housing market, with little inventory and bidding wars driving up home prices.

"We use recent, arms-length sales, we use the comparable sales approach to valuation, so we look at sales in your neighborhoods," said Younger.

You can fight the higher bill, however. New values will be posted to the Jefferson PVA website at noon on April 26. They will also be mailed out to homeowners. If you don't agree with your new assessment, you have the right to appeal, and you can do so through May 20.

"The people who come to us with a valid case, substantiated, win," Younger said.

Property taxes fund Jefferson County Public Schools, fire departments and city services.

There are two more meetings coming up. April 16 at the Jeffersonian and April 18 at United Crescent Hill Community Ministries. Both meetings are from 6:30-8 p.m.

Copyright 2024 WDRB Media. All Rights Reserved.